Key financial figures

EUR 130m

Nefco’s own capital

EUR 653m

in trust fund assignments

EUR 412m

committed to green investments and projects

Nefco’s own capital

At the beginning of 2023, Nefco’s own capital amounted to EUR 119.3 million. At the end of the year it totalled EUR 130.0 million, mainly due to increased lending to Nordic SMEs and earnings from interest, as well as repayments of pre-war investments in Ukraine. The return for the 2023 financial year was EUR 10.8 million (2022: EUR -53.3m).

At the end of 2023, Nefco had 83 active investments, with a total of EUR 205.2 million in committed funds (2022: 78, EUR 214.8m) in the investment portfolios of Nordic SMEs and Eastern Europe. In 2023, eight new Nordic SME scale-up investments of EUR 20.8 million (2022: 12; EUR 37.1m) and four fast-track loans totalling EUR 1.8 million (2022: 7; EUR 3.1m) were agreed.

Based on a preliminary assessment, the leveraging ratio of Nefco financing is estimated to be 2.0-4.0, meaning that for each euro of Nefco financing, two to four euros of additional financing have been mobilised for the project or company being financed.

Further information can be found in www.nefco.int/about.

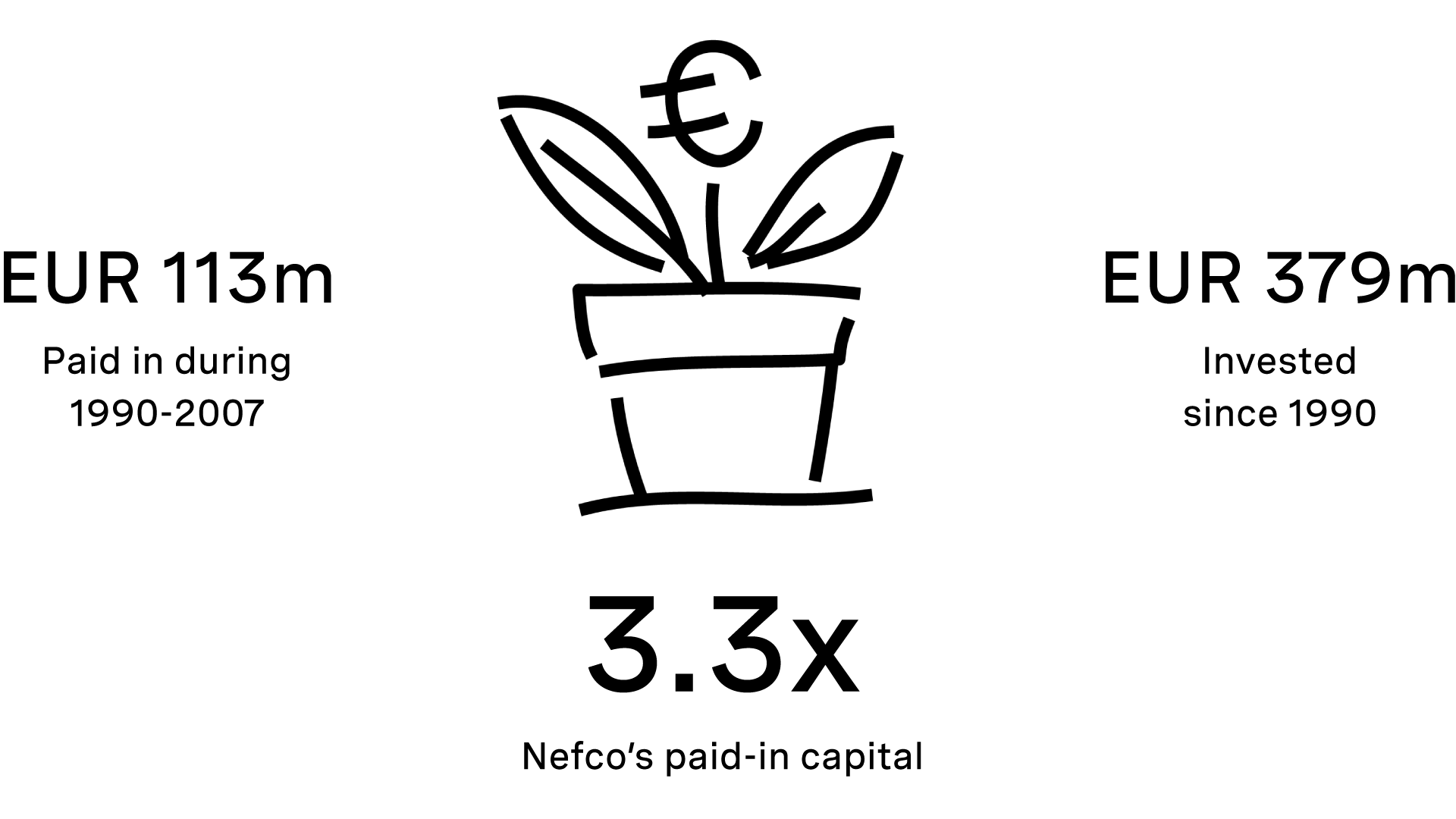

Paid-in capital — the base for Nefco's green financing

Nefco’s paid-in capital has been invested 3.3 times while supporting Nordic environmental and climate-related goals.

Nefco’s trust fund management

In addition to its own capital, Nefco manages funds on behalf of others, mainly Nordic governments and the European Union, as assigned by the trust fund owners. In most cases, the funds are dispersed as various types of grants, but they can also be provided in the form of concessionary loans or results-based grant financing.

At the end of 2023, the value of Nefco’s trust fund assignments totalled EUR 653 million (2022: EUR 498.3m). Of this, EUR 440 million (2022: EUR 261m) had been allocated to concluded, agreed and ongoing projects. At the end of the year, there were 241 active trust fund projects with a total of EUR 206.8 million in committed funds.

During 2023, EUR 46.5 million was disbursed to trust fund projects (2022: EUR 16.3m).

Nefco's own capital and Trust Funds at end of year

Total funds committed to projects at end of year

Agreed investments from Nefco's own capital