Photo: Coolbrook

Green transition for Nordic SMEs

Small and medium-sized companies (SMEs) play a significant role in the economy and green transition, but they often have a higher financial risk profile than is acceptable for traditional commercial banks. Financing that fills the gap – the so-called ‘missing middle’ – is needed to support these companies in their initial growth phase and attract other investors and private sector financing.

One of Nefco’s strategic goals is to contribute to the growth, competitiveness and green transition of these companies. We particularly emphasise sectors in which the Nordics demonstrate key competencies and innovation and where new jobs can be created in both the Nordic and project countries involved. To facilitate nature-positive measures, we have a tailor-made Biodiversity Pilot Programme for SME clients.

There is increasing demand for SME financing, and the total project portfolio, including our own investments and managed trust funds, is growing. At the end of the year, our Nordic SME portfolio comprised 70 active loans and equity-type investments (including 11 pre-war investments in Ukraine) and 111 feasibility studies through Nopef.

Funds committed to the active Nordic SME portfolio

Case

Coolbrook: Accelerating the decarbonisation of heavy industries

Hard-to-abate industries, such as steel, iron, cement, petrochemicals and chemicals, are responsible for over 60% of the total CO2 emissions from industry. Industrial processes require high temperatures, which are almost exclusively achieved by burning fossil fuels.

Finnish technology and engineering company Coolbrook has developed a technology that utilises electricity and harnesses rotational kinetic energy to produce the extreme heat required for many heavy industrial processes. The technology, named RotoDynamic, is currently the only electric heating technology with the potential to achieve temperatures of 1,700°C without the use of fossil fuels. Replacing fossil-fired furnaces and kilns in industrial processes would enable heavy industries to decarbonise at scale.

The technology has two main applications: the RotoDynamic Reactor, which could be used to achieve 100% CO2-free olefin production, and the RotoDynamic Heater, which provides a carbon-free heating process for iron, steel, cement and chemical production.

Loan financing from Nefco will support the commercialisation and scale-up of RotoDynamic Heater technology. The technology is currently undergoing a large-scale pilot phase in the Netherlands, demonstrating its performance across various industrial sectors. The next milestone is to deploy the technology in initial commercial demonstration projects at customer sites in 2024, while full commercial deployment is expected to start around 2025.

The Nordic SME business unit offers three different financing instruments

- Nopef – Feasibility study support, funded by the Nordic Council of Ministers

- Fast track – Standardised Nefco loans up to EUR 500,000 per project

- Scale-up – Nefco loan or equity-type financing up to EUR 5m per project

Scale-up investments and fast-track loans

Nefco provides loans and equity-type financing for Nordic SMEs from its own capital to facilitate investments in innovation-driven green solutions and technologies with global scale-up potential. Investments are spread across a wide range of sectors, but the emphasis continues to be on solutions related to climate change mitigation.

Many Nordic SMEs face operational challenges, such as supply chain issues, effects from Russia’s war in Ukraine and deteriorating market conditions for raising risk capital. Our fast-track loans can be used for investments and business activities that drive international growth.

Support for entry on new markets through Nopef

Nordic SMEs can also receive financial support through Nopef, the Nordic Project Fund, for feasibility studies aimed at internationalisation. Nopef is a separate fund, financed by the Nordic Council of Ministers and managed by Nefco. Its objective is to contribute to the green transition by supporting the internationalisation of innovation-driven Nordic environmental and climate solutions.

Nopef-funded projects are spread across a wide range of sectors, but the emphasis continues primarily to be on solutions related to climate change mitigation. The most common sectors are energy, manufacturing and water supply, sewerage, waste management and remediation.

Environmental drivers of the Nordic SMEs portfolio based on percentage of committed funds at the end of 2023

Sectors represented in the Nordic SME portfolio based on percentage of committed funds at the end of 2023

Case

Circular economy solution based on biowaste

Growing crops to feed animals, subsequently consumed by humans, is inefficient. A circular solution, utilising biowaste to feed larvae for animal feed, offers a more resource-efficient alternative. Research indicates that insect proteins can be 2–5 times more sustainable than comparable traditional agricultural products.

Nopef co-funded a feasibility study for the Finnish company Manna Insect into the expansion of its circular agricultural solution to Kenya. Manna Insect’s solution enables local insect production while processing biowaste and providing improved animal feed, along with a fertiliser byproduct.

Biodiversity also matters for SMEs

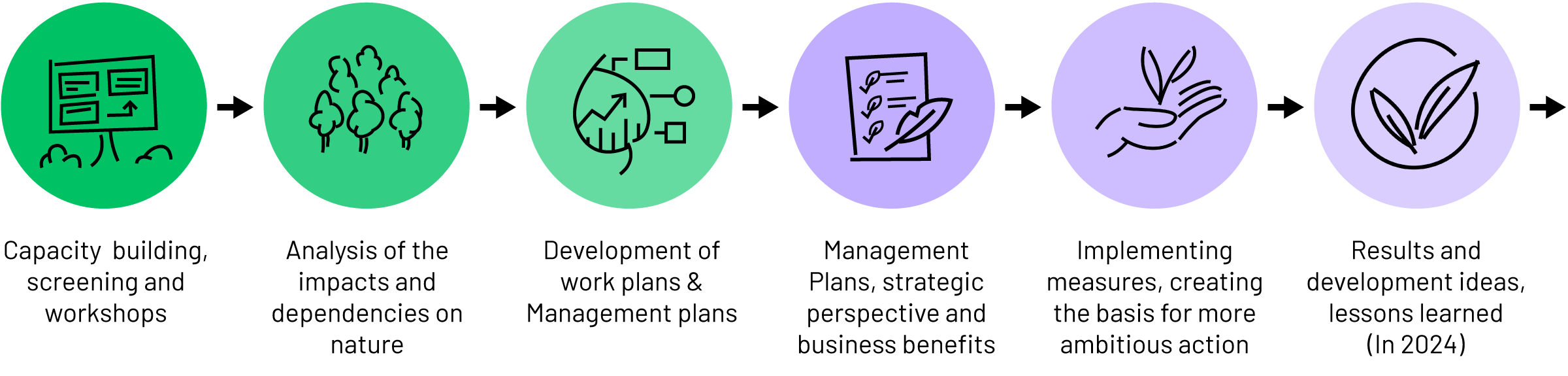

Nefco’s Biodiversity Pilot Programme is tailor-made for Nordic SMEs. It aims to provide a leading example and inspire companies and project owners to think in terms of nature-positive measures. In 2023, Nefco hosted several workshops for participating Nordic companies through which they reached important milestones, such as helping them analyse their impacts and dependencies on nature and develop concrete biodiversity management plans.

|

The initial programme results show evident systematic change in the pilot companies’ operations and practices. The programme has fostered business benefits such as new product offerings, sales support and customer outreach and has led to the adoption of group-wide sustainability strategies.

Full story: Biodiversity pilot programme

“Financing that fills the so-called ‘missing middle’ is needed to support SMEs in their initial growth phase and attract other investors.”